Renters Insurance in and around Aurora

Aurora renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Calling All Aurora Renters!

Your rented house is home. Since that is where you make memories and relax, it can be a wise idea to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your craft supplies, tablet, guitar, etc., choosing the right coverage can help protect your belongings.

Aurora renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

State Farm Has Options For Your Renters Insurance Needs

It's likely that your landlord's insurance only covers the structure of the condo or home you're renting. So, if you want to protect your valuables - such as a dining room set, a desk or a tablet - renters insurance is what you're looking for. State Farm agent Rodrigo Menendez can help you choose the right policy and insure your precious valuables.

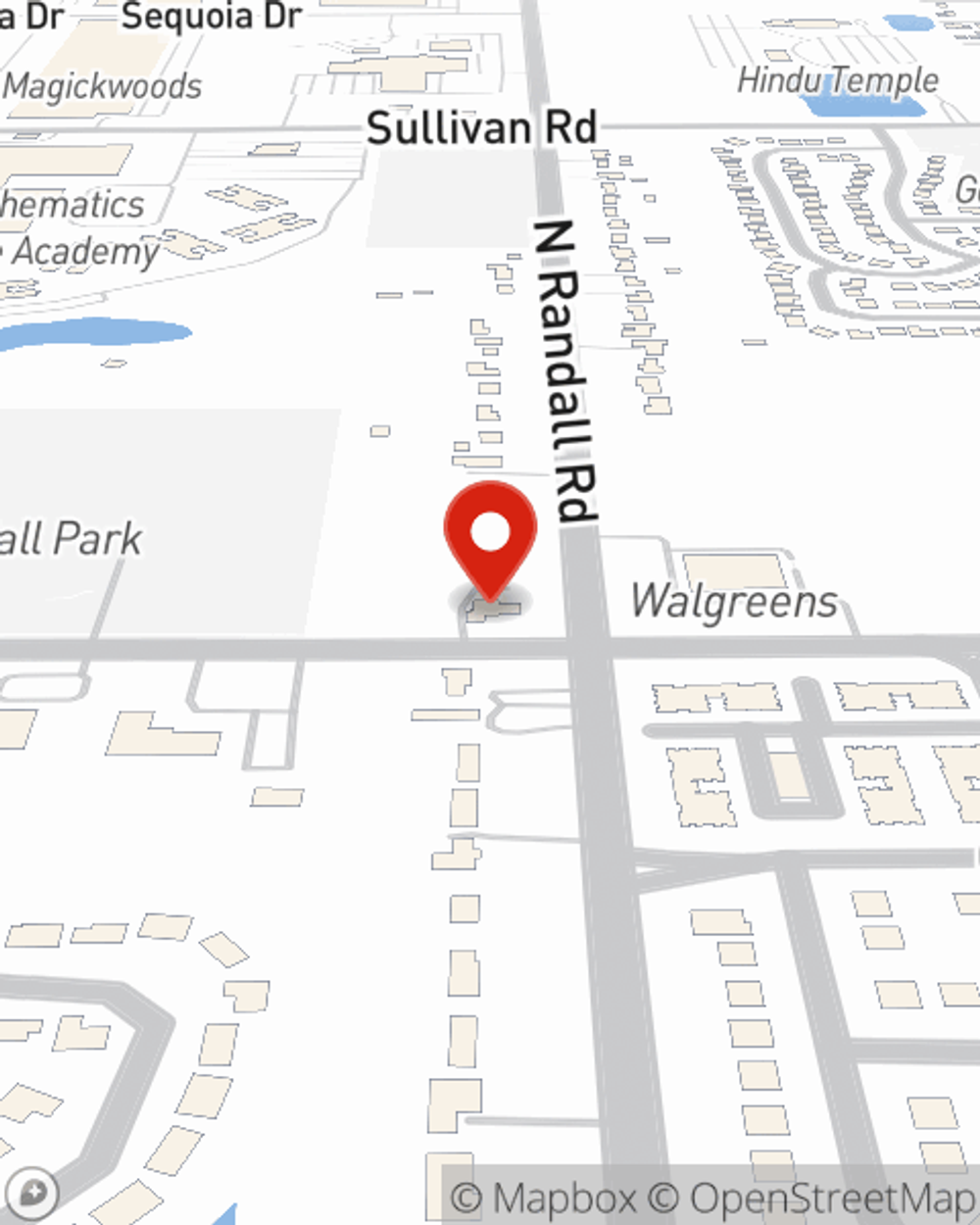

A good next step when renting a residence in Aurora, IL is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online now and learn more about how State Farm agent Rodrigo Menendez can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Rodrigo at (630) 981-0101 or visit our FAQ page.

Simple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Rodrigo Menendez

State Farm® Insurance AgentSimple Insights®

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.